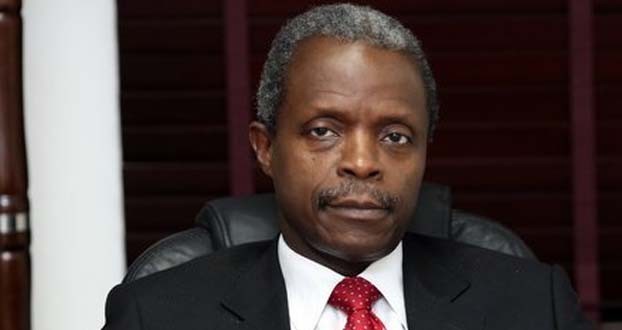

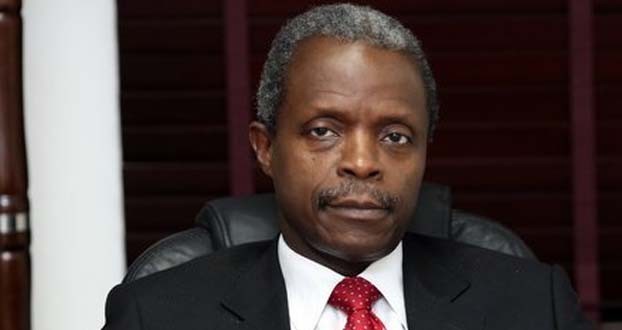

The Naira has made appreciable gains against the dollar in the last couple of hours. Here’s the back story to it all. This time last week, the Naira was in a race of its own for the bottom. Nigeria’s currency just couldn’t be stopped. At the parallel market just a few days ago, the Naira closed trading at N525 to the Dollar. Economists and speculators were so sure that trading would close at N600/$1 before mid March, 2017. However, on February 20, 2017, the Central Bank of Nigeria (CBN) tweaked its foreign exchange policy following marching orders from the national economic council headed by Vice President Yemi Osinbajo.

More..

- #BBNaija: This is proof that TTT doesn’t love his wife – She will cry after seeing this (Video)

- 5 things you must know about Osinbajo’s official car – It’s one of the most expensive cars in the world

- #BBNaija: TBoss puts her bo*bs on full display again (18+ Photos/Video)

- 9 Countries where Nigerians can easily get permanent residency – #2 will shock you big time!

Osinbajo and finance minister Kemi Adeosun mandated the CBN headed by its Governor Godwin Emefiele, to review its monetary policy.

“Council members generally expressed concern over the current situation of the exchange rate and called for an urgent review of the current forex policy, especially interbank and parallel market rates”, Silas Ali Agara, Deputy Governor of Nasarawa State, told the press after the meeting.

In the past, Emefiele had been advised to do something about the falling Naira.

Adeosun and Emefiele have had public disagreements over the bank’s monetary policy in the past.

This time, the CBN Governor was left with no choice, one top ranking government official who was at the meeting, told Pulse.

Emefiele was read the riot act.

“We told the CBN Governor that he had to do something urgently. It was an order”, the official said.

Five days later, the CBN rolled out a raft of new forex policies.

“In continuation of efforts to increase the availability of foreign exchange in order to ease the difficulties encountered by Nigerians in obtaining funds for foreign exchange transactions, the Central Bank of Nigeria (CBN) is providing direct additional funding to banks to meet the needs of Nigerians for personal and business travel, medical needs and school fees, effective immediately.

“The CBN expects such retail transactions to be settled at a rate not exceeding 20 percent above the interbank market rate,” a statement signed by the apex bank’s Director of corporate communications, Isaac Okorafor, read.

Discussion about this post